Many Beneficiaries wonder, what the best way is to pay for Medicare. In this blog, we’ll break down the essential details in simple terms, so you can effortlessly manage your healthcare expenses, and avoid a potential loss in coverage.

For the majority, Medicare Part A doesn’t require a monthly premium. Nevertheless, if you’re subscribed to Medicare Part B and you’re already receiving benefits from Social Security or Railroad Retirement Board, your Medicare Part B premium is commonly subtracted from your monthly benefit payment.

However, if you have Medicare Part B but haven’t started receiving Social Security or Railroad Retirement Board benefits, you can expect to receive a monthly bill known as the “Notice of Medicare Premium Payment Due” (CMS-500). You’ll have to arrange for payment of this bill every month.

Let’s start with the basics

What’s a premium, deductible, coinsurance, or copayment?

Premium: A monthly amount you pay for coverage, whether you get services or not.

Deductible: An amount you have to pay for covered services and items each year before Medicare or your plan starts to pay.

Coinsurance: A percentage of the cost that you pay. In Part B, you generally pay 20% of the cost for each Medicare-covered service.

Example

A Medicare-covered service costs $100. Medicare pays $80 and you pay $20. ($100 x 20% = $20.)

Copayment: A fixed amount you pay for a Medicare-covered service, like $30.

There are 4 ways to pay your Medicare premium bill:

- Pay online through your secure Medicare account (fastest way to pay)- use this free service to pay by credit card, debit card, or from your checking or savings account.

- Pay directly from your savings or checking account through your bank’s online bill payment service- Some banks charge a service fee.

- Sign up for Medicare Easy Pay– free service, sign up to automatically deduct your premium payments from your savings or checking account each month.

- Pay by check or money order through mail – this is not an automatic payment set up, therefore it is up to the Medicare beneficiary to remember to submit their monthly payments on time.

When are Medicare premiums due?

All Medicare bills are due on the 25th of the month. In most cases, your premium is due the same month that you get the bill. For your payment to be on time, we must get your payment by the due date on your bill. Submit your payment at least 5 business days before the due date, so we can get it on time.

For your payment to be on time, we must get your payment by the due date on your bill. Submit your payment at least 5 business days before the due date, so we can get it on time.

What if your Medicare premium payment is late?

If you miss a payment, or if we get your payment late, your next bill will also include a past due amount.

If you get a Medicare premium bill that says “Delinquent Bill” at the top, pay the total amount due, or you’ll lose your Medicare coverage

Automatic Deduction from Social Security for Medicare Part B Premiums- What you need to know!

If you’re receiving Social Security benefits, it’s important to understand how Medicare premiums work.

If you receive Social Security benefits, your Medicare Part B premiums are automatically deducted from your monthly Social Security check.

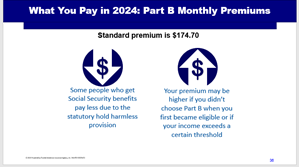

The standard monthly deduction for most beneficiaries in 2024 is $174.70, covering Medicare Part B.

Please be aware, you won’t receive a separate bill for Medicare premiums, but you’ll get a monthly statement that details the deduction from your Social Security check.

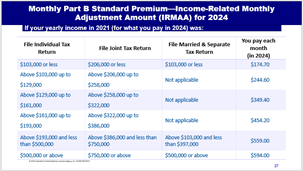

Below is the Income-Related Monthly Adjustment Amount (IRMAA) for 2024.

Enrolled in Medicare but NOT Claiming Social Security Benefits? Here’s how to sign up!

You can sign up for Medicare Easy Pay Medicare Easy Pay | Medicare, a FREE service allowing automatic withdrawals of your monthly premiums from your checking or savings account.

Medicare Part A Premiums

Most people don’t pay Medicare Part A premiums, but if you haven’t paid Medicare taxes for at least ten years through your job, you may need to pay these premiums.

The 2024 Medicare Part A premium varies based on the number of quarters you’ve worked and paid Medicare taxes.

Medicare Advantage Plans and Part D Prescription Drug Plans

Some Medicare Advantage plans, and standalone Medicare Part D drug plans may offer the option to have your premiums deducted from your Social Security check. However, this is not an automatic process and you’ll need to contact your plan administrator to set it up or request it during enrollment.

Coinsurance: A percentage of the cost that you pay. In Part B, you generally pay 20% of the cost for each Medicare-covered service.

Example

A Medicare-covered service costs $100. Medicare pays $80 and you pay $20. ($100 x 20% = $20.)

Copayment: A fixed amount you pay for a Medicare-covered service, like $30.

There are 4 ways to pay your Medicare premium bill:

- Pay online through your secure Medicare account (fastest way to pay)- use this free service to pay by credit card, debit card, or from your checking or savings account.

- Pay directly from your savings or checking account through your bank’s online bill payment service- Some banks charge a service fee.

- Sign up for Medicare Easy Pay– free service, sign up to automatically deduct your premium payments from your savings or checking account each month.

- Pay by check or money order through mail – this is not an automatic payment set up, therefore it is up to the Medicare beneficiary to remember to submit their monthly payments on time.

When are Medicare premiums due?

All Medicare bills are due on the 25th of the month. In most cases, your premium is due the same month that you get the bill. For your payment to be on time, we must get your payment by the due date on your bill. Submit your payment at least 5 business days before the due date, so we can get it on time.

For your payment to be on time, we must get your payment by the due date on your bill. Submit your payment at least 5 business days before the due date, so we can get it on time.

What if your Medicare premium payment is late?

If you miss a payment, or if we get your payment late, your next bill will also include a past due amount.

If you get a Medicare premium bill that says “Delinquent Bill” at the top, pay the total amount due, or you’ll lose your Medicare coverage

Automatic Deduction from Social Security for Medicare Part B Premiums- What you need to know!

If you’re receiving Social Security benefits, it’s important to understand how Medicare premiums work.

If you receive Social Security benefits, your Medicare Part B premiums are automatically deducted from your monthly Social Security check.

The standard monthly deduction for most beneficiaries in 2024 is $174.70, covering Medicare Part B.

Please be aware, you won’t receive a separate bill for Medicare premiums, but you’ll get a monthly statement that details the deduction from your Social Security check.

Key Takeaways:

- If you receive Social Security benefits, your Medicare Part B premiums will be taken directly from your monthly Social Security payment.

- There are 4 other ways to pay your Medicare Premium.

- If you have a Medicare Advantage or Medicare Part D drug plan, you can inquire with your plan administrator about the possibility of deducting your premiums from your Social Security benefit.

- For those enrolled in Medicare but not receiving Social Security benefits, you can arrange for your monthly premiums to be automatically withdrawn from your checking or savings account by reaching out to Medicare.

In the world of Medicare, staying on top of your premiums is more than just a chore—it’s a vital step in ensuring seamless healthcare coverage. Failure to make timely payments can lead to the dreaded consequences of delinquent accounts and even the loss of coverage.

If you would like to learn more about how to set up your automatic payments to pay for your Medicare Premiums, you may contact us today.

Resources: